Hurricanes and typhoons are two of nature's most formidable creations, both capable of leaving devastation...

Monsoons and tropical storms are meteorological phenomena that can have significant impacts on the regions...

The Balanced Literacy vs. Science of Reading debate continues, with educators, researchers, and policymakers weighing...

Understanding the science of reading is an academic pursuit and a gateway to personal and...

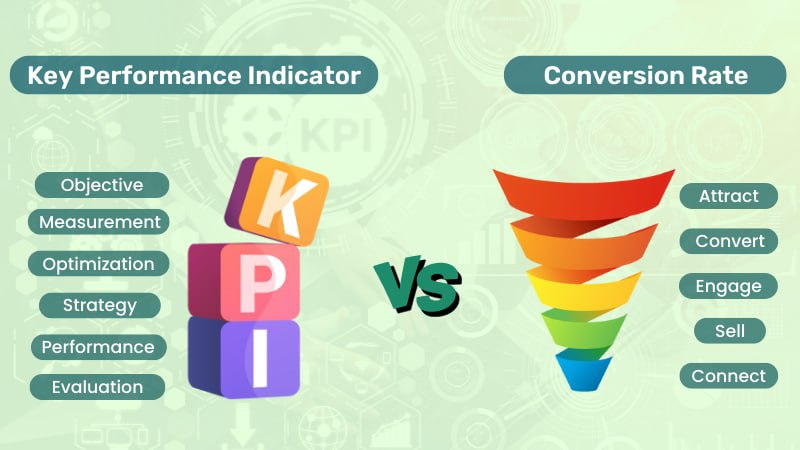

Key Performance Indicator (KPI) is a productivity metric that measures whether a business is meeting...

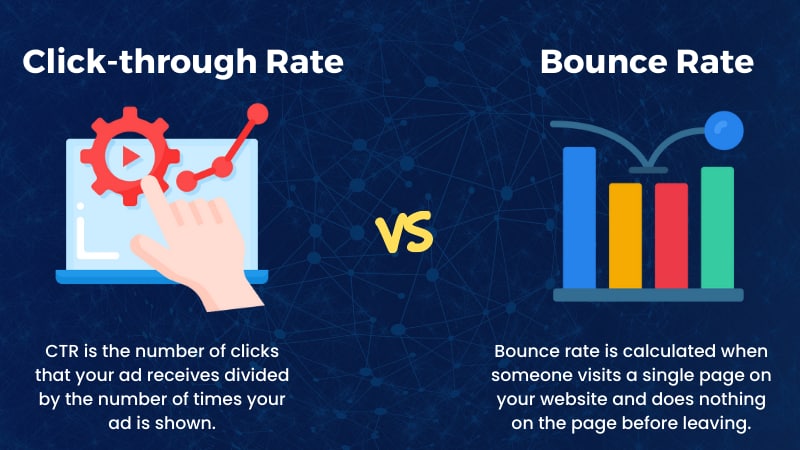

The number of visitors who clicked on your advertisement and went to a home page...

A DTC (Direct-to-Consumer) Startup is a business strategy centered around selling its offerings directly to consumers, sidestepping conventional middlemen like...

Brown noise is a type of sound that falls in the lower-frequency range of the audio spectrum. It's characterized by a deep, rumbling quality that's often...

Green Noise is a term that refers to a specific type of auditory experience. It's not about the sound of rustling leaves ...

Voluntary exchange is willingly trading goods, services, or resources between two or more parties without coercion or force.

Green tech is designed to reduce the human ecological impact and fight against climate change.

A sublease is a contract for residential or commercial space between original tenants and another third party