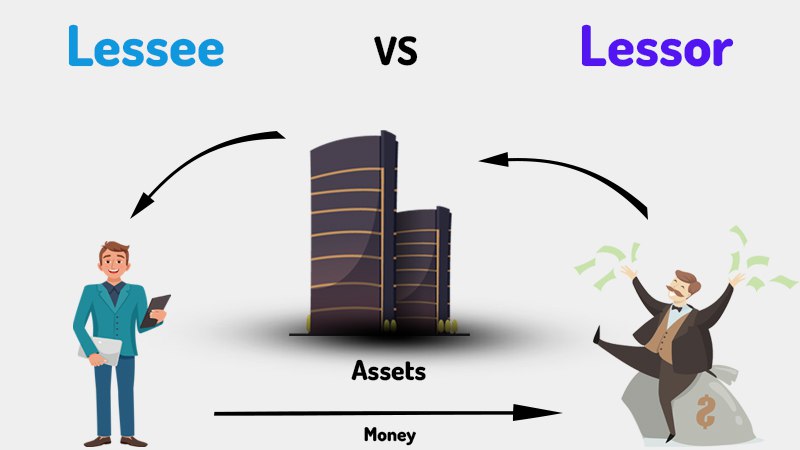

In a leasing arrangement, there seem to be two main parties. A lease is an agreement in which one entity, the lessor, delivers an item to be used by the other, the lessee, in exchange for installments over a particular time frame.

For the use of the underlying asset, the lessee ends up paying the lessor. The contract is agreed upon by both entities, and they are bound by its terms. The agreement can be canceled if any party violates the terms of the lease contract.

Check out the Comparison Table

Who is Lessor?

The lessor is the entity that gets money in return for the use of its asset or property in a lease term. A lessor is a person who lends properties to someone else. For example, if you want any other person to live in your house on a rental basis, then you can be called the lessor who is holding or owning the land.

Characteristics of a Lessor

The characteristics of a Lessor are as follows-

- The lessor is the one who gets money in return for the use of its ownership interest in a lease contract.

- The lessor shall provide his or her approval for the property to be leased, and in this scenario, the lessor is subjected to any monetary returns.

- When both the lessee and the lessor agree to a tenancy contract, it becomes legal.

- Repairing and servicing not majorly affected by the lessee shall become the responsibility of the lessor.

- The asset or property might be surrendered to the lessor on certain expiry of the rental contract, or if other factors lead the placement to cease before that time.

- The lessor generally bears the tax payment.

Who is Lessee?

The lessee is the one who leased or borrowed any property or asset from a lessor. As they give payment in exchange for living in a property for a specific period of time, they have primary control of the asset, which is generally free of mortgages or other liabilities. They must fulfill all regulatory requirements while negotiating a lease arrangement. For example, you are the lessee if you rent a home from a local dealer.

Characteristics of a Lessee

A lessee has some distinct characteristics of its own. These are as follows -

- In a lease arrangement, the lessee is the person who gets the entitlement to use a facility or property for a specific duration in exchange for periodical payments according to the deal.

- With a relatively small payment, the lessee gains possession of a property.

- During the lease time, the lessee is liable for the resource or property's supervision and any needed servicing.

- Without the approval of the lessor, the resource or asset will not be greatly modified, and the lessee must fix any damages before the agreement's expiry date.

- For the lessee, a rental agreement is a flexible alternative because the agreement can be canceled if the lessee no longer requires the property.

- The lessee doesn't have to pay the tax.

Key Differences Between Lessor and Lessee

The key differences between lessor and lease are as follows –

Comparison Table

Let’s take a look at the comparison table below so that the details and differences can be pinpointed precisely-

|

Basis of Comparison |

Lessor |

Lessee |

|

Definition |

Owns the asset or property and rents it to the lessee. |

Rents the asset or property from the lessor. |

|

Status |

The legal owner of the asset. |

Does not have legal ownership status. |

|

Compensation |

Receives money in exchange for allowing the lessee to use the property. |

Get the asset or property for temporary use, and in return pays the lease. |

|

Legal restrictions |

Very few restrictions. |

Restrictions are much higher. |

|

Taxation |

Takes care of tax payments. |

Does not have to pay the taxes. |

|

Utility charges |

Not responsible for the payment of utility charges. |

Till the time the asset is with the lessee, is responsible for paying for the utility charges. |

|

Termination of contract |

Can cancel the agreement if the lessee causes a problem to his assets or if the lessee violates any of the terms agreed upon. |

In the event of an unforeseen incident like a natural calamity, the lessee has the option to end the lease. |

Ownership

The lessor has the ownership and authority to sell it to anyone. The lessee, on the other hand, is the short-term holder, and his ownership is limited to the agreement's terms and the agreed-upon price.

Control

The lessee has control of the asset, while the lessor has authority. Who controls what? - is one of the key distinctions between these two parties.

Liability

If the lessee goes through bankruptcy, the lessor will try to get the payouts from the lessee first. Because the lessor doesn't owe the lessee any payment but the lessee has to make the payment if any amount is due.

Restrictions

Because the lessor owns the property, he has no restrictions on how he should use it. When the asset is under-leased, therefore, approval is needed. The house or property is under the control of the lessee for the time being.

Payment

The value of the leasehold or rent is usually paid to the lessor. The lessee, on the other hand, benefits from having temporary access to the property without needing to spend the full price level.

Right to Cease

The lessor has the right to dismiss if the lessee causes a problem to his assets or if the lessee violates any of the terms in the agreement. In the event of an unexpected incident such as a natural calamity, manmade damages etc. the lessee has the option to decline the lease.

Right to Transfer

The lessor, as the owner of the asset, has full rights to control the resources or assets from the existing lessee and lend it to another lessee. The lessee, on the other hand, is not granted this power. He has no legal authority to allow anyone else to utilize the land.

Practical Example

Here is a few examples that would enhance your understanding of the terms more precisely.

Example 1

David is looking for a tenant for his flat. A man named Mario is interested in renting the house for a fee. Mario (the tenant) is the lessee in this case. The lessor is David (the landlord). The lessee ends up paying the owner rent, whereas the lessor is paid by the resident. Any lease option contract follows the same approach. The lessor receives payment from the lessee in exchange for allowing to utilize the resource or asset. Furthermore, the lessee pays the lessor for the use of the ownership interest.

Example 2

Lifestyle Ltd. is a firm that operates globally. In the context of a logo or brand name, the lessor is the firm (Lifestyle Ltd.) that controls the copyright or brand reputation and has granted the franchisee the right to use it. The franchisee would be the lessee in this case.